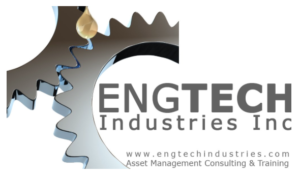

Let’s start with some recapping: In Part 5 of this series on Availability (see links to all parts below) we addressed market- and marketing-induced causes for “unavailability,” with a focus on undersold capacity. In this concluding installment, our attention turns to oversold production capability, imposed short-runs, and frequent product changeovers. As shown in the dark green boxes in Fig. 1, these are the other market- and marketing-induced causes for equipment downtime and unavailability.

Fig. 1. Oversold production capability and imposed short-runs

and frequent changeovers are marketing-induced

OEE losses that impact availability.

OVERSOLD PRODUCTION CAPABILITY

When designing assets, engineers work from a requirements-specification based upon what the firm’s marketing experts and business leaders anticipate will be marketable and salable to current and future customers. Ideally, the engineering team will focus on design for reliability, operability, and maintainability (the major drivers for asset Availability). However, design for flexibility is another important element, especially where the asset will be required to manufacture multiple products or deliver multiple packaging or labeling solutions.

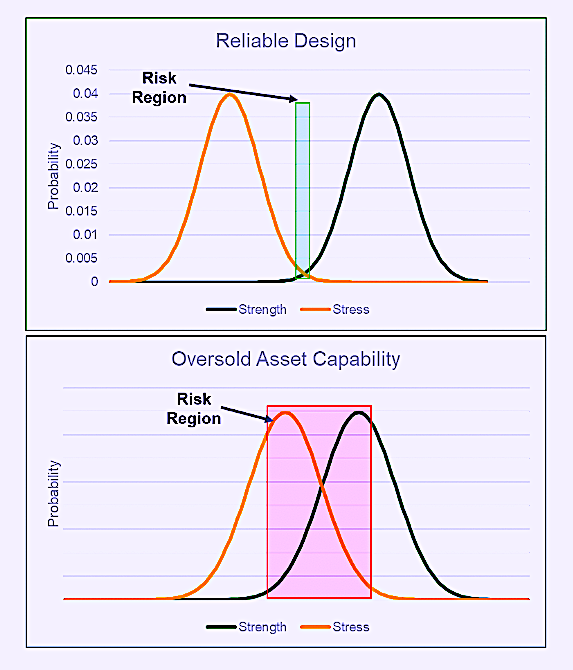

In Part 1 of this Availability series, I addressed Single-Minute Exchange of Die (SMED). SMED is a component of the Toyota Production System (TPS), whereby the goal is to accomplish a production changeout in a single-digit number of minutes. It’s a “pitstop” mentality. This capability can be built in with a focus on design for flexibility. When all goes right, we have a reliable design, one with a strength that sufficiently exceeds the stress placed upon it. There’s no “interference” between the stress and strength distribution curves (Fig. 2).

This all presumes the current and future requirements to serve customers are accurately specified by the marketing organization and business leaders. In practice, marketing and sales professionals are naturally predisposed to satisfy customer demands, wants, and desires. Unfortunately, while these individuals are skilled in the craft of sales and marketing, they may not have detailed knowledge about the manufacturing process and its assets. A customer may request a product, packaging, and/or labeling solution that seems minor to the salesperson. If a commitment is made and a contract signed, the manufacturing plant must deliver on the commitment. That scenario can affect an asset’s Availability in two ways:

1. Increased Stress vs. Strength Interference. As previously discussed, assets are designed so s to minimize stress vs. strength interference. If meeting the commitment to the customer pushes the asset beyond it’s limit, the stress curve moves to the right and creates interference between the stress and strength distribution curves and introduces risk to the asset (Fig. 2). If this scenario occurs frequently, the integrity of the asset suffers. This will eventually compromise the asset’s reliability and affect Availability.

2. Compromised SMED Performance. In many cases, honoring commitments to customers that fall outside of an asset’s capability requires modifications to the asset. In some cases, the modifications can be accomplished in a matter of hours. However, I’ve personally participated in such events, where an asset ended up being unavailable for a week or more. I’ve also observed situations where meeting a customer commitment required a capital acquisition to modify assets for what turned into a one-off production run. These are very counterproductive marketing-induced situations.

Fig. 2. Exceeding the design limit of the asset introduces

stress vs. strength interference and Availability risk.

Avoiding situations where commitments are made that exceed the production capability of assets requires communication among marketing/sales, production, and asset management functions within the firm. The marketing and sales team must know what the assets can and can’t do and, before committing to a customer for deviations from the standard production profile, they must check with the production and asset-management teams. Of course, there are situations where a deviation represents a new offering for the company and significant business opportunity. Still, that type of situation should reflect a strategic, expansive, capital campaign, not a one-off casual commitment to a customer.

IMPOSED SHORT-RUNS/FREQUENT CHANGEOVERS

The time it takes to change a production line or process to a different product, a variation of a product, or an alternate packaging or labeling solution can eat up a lot of availability. If the production and operations teams are SMED pros, this loss can be minimized. But, interestingly, marketing and sales also have a big impact on changeover frequency. This is particularly the case in consumer-product manufacturing operations. As a reliability engineering consultant, I was brought in to help a consumer-products manufacturer improve the availability of its European plant, which significantly lagged the company’s North American operations. Management had assumed that the plant assets weren’t being properly maintained.

I flew to Europe and spent two weeks in the facility. And, yes, we found a few opportunities to improve its maintenance practices. However, my report to senior managers in the U.S. was somewhat of a surprise to them: I stated that equipment assets were being maintained better in Europe than in the company’s North American plants. Furthermore, I noted that, in my opinion, the European production teams were better at SMED practices than their counterparts in North America. I also suggested that the problem was marketing and advised the managers to consider firing some customers.

That project occurred at a time when the European Union was young. Europe is comprised of about 160 distinct cultures, as opposed to what experts believe are 11 distinct cultures in the USA. Moreover, there are 24 official languages among the 27 countries in Europe. (For comparison purposes, consider the fact that the United States is predominately a nation of English-speakers, with a growing base of Spanish-speakers.) Each of the many European cultures, countries, and languages resulted in sales and marketing commitments for very short production runs with assets that weren’t designed for such flexibility. In some instances, the production teams spent 15 minutes to changeover for a production run that lasted five minutes, and more product was thrown away than was sold because of subsequent startup-stability quality losses. Management asked me for options. I gave them three:

1. Invest capital and redesign the plant for “mass customization” where flexibility is maximized.

2. Build a giant warehouse and increase inventory to meet customer requirements without absurd short-runs.

3. Discontinue serving customers that demand modifications that result in excessive short-runs.

The company opted for a combination of options 2 and 3 (with a heavier tilt toward 3). So, we embarked on a campaign to educate the organization’s sales- and marketing-team members about what the assets could and couldn’t do. They resisted at first, which was natural because sales and marketing professionals want to please customers. But they eventually came around, and communication and cooperation sales and marketing and the plant-based teams improved significantly.

CONCLUSIONS

In this six-part series on Availability, the first element of Overall Equipment Effectiveness, we’ve explored the many planned and unplanned equipment, production and operations, and marketing-induced losses. It’s essential that we account for every second, minute, and hour of lost production Availability and clarify the true reason for the loss. which may be equipment-, production-, or market/marketing-induced.

By default, the cause of unavailability is usually pinned on the equipment. But, quite simply, equipment is not always the culprit. In some cases, unavailability is caused by improper production or operations, or market- and marketing-induced issues. It’s also important to keep in mind that the true cause for equipment unavailability is not always readily visible. The incorrect assumptions by my client regarding the performance of its European plant are a case in point.

In my next article, the focus will be on equipment-, production-, operations-, and market/marketing-induced causes for yield or speed losses.TRR

Click The Following Links To Previous OEE And Availability Articles

“Lagging Indicators For Asset Management: OEE (Sept. 5, 2021)

“OEE’s First Element: Availability, Part 1” (Sept. 13, 2021)

“OEE’s First Element: Availability, Part 2” (Sept. 27, 2021)

“OEE’s First Element: Availability, Part 3” (Oct. 3, 2021)

“OEE’s First Element: Availability, Part 4” (Oct. 11, 2021)

“OEE’s First Element: Availability, Part 5” (Oct. 24, 2021)

REFERENCES

Troyer, Drew (2008-2021). Plant Reliability in Dollars & $ense Training Course Book

ABOUT THE AUTHOR

Drew Troyer has over 30 years of experience in the RAM arena. Currently a Principal with T.A. Cook Consultants, he was a Co-founder and former CEO of Noria Corporation. A trusted advisor to a global blue chip client base, this industry veteran has authored or co-authored more than 300 books, chapters, course books, articles, and technical papers and is popular keynote and technical speaker at conferences around the world. A Certified Reliability Engineer (CRE) and a Certified Maintenance & Reliability Professional (CMRP), he holds B.S. and M.B.A. degrees. Drew, who also earned a Master’s degree in Environmental Sustainability from Harvard University, is very passionate about sustainable manufacturing. Contact him at 512-800-6031, or email dtroyer@theramreview.com.

Tags: reliability, availability, maintenance, RAM, metrics, key performance indicators, KPIs, OEE