In Part 4 of this series on Availability, the first element of Overall Equipment Effectiveness (OEE), we focused on production-induced causes for “unavailability.” (See links to previous installments below.) This week, we will be turning our attention to marketing- and market-induced causes for equipment downtime and unavailability.

Click The Following Links To Previous OEE And Availability Articles

“Lagging Indicators For Asset Management: OEE (Sept. 5, 2021)

“OEE’s First Element: Availability, Part 1” (Sept. 13, 2021)

“OEE’s First Element: Availability, Part 2” (Sept. 27, 2021)

“OEE’s First Element: Availability, Part 3” (Oct. 3, 2021)

“OEE’s First Element: Availability, Part 4” (Oct. 11, 2021)

Granted, those of us in the equipment-asset-management community don’t always think about the important role marketing plays in determining our production equipment’s availability. The reason is simple: Marketing teams rarely get out on the plant floor. And they rarely have any interaction with actual production equipment.

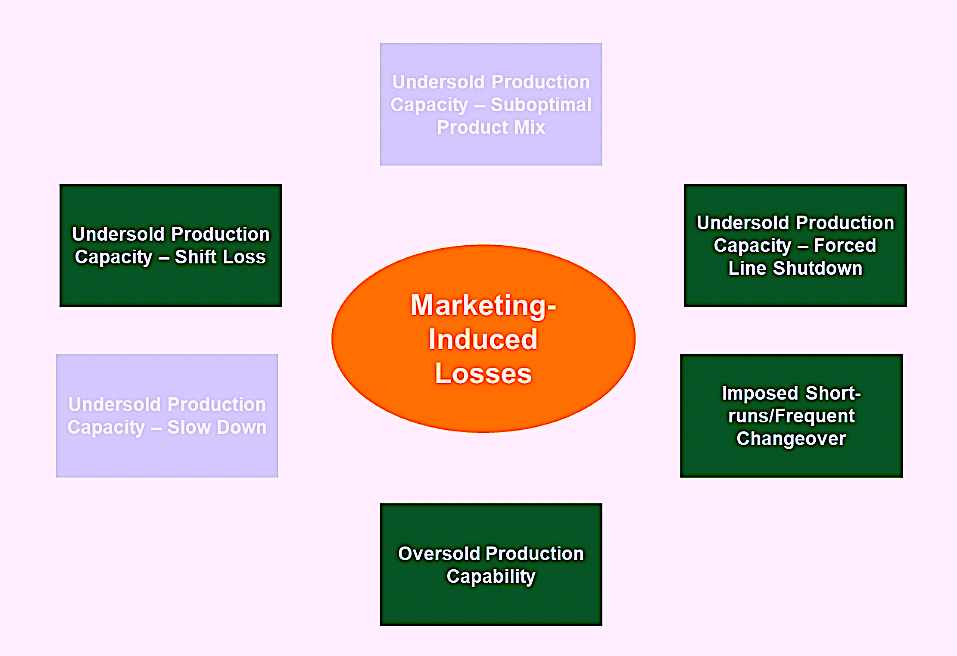

Make no mistake, however: Markets and marketing greatly influence production availability in many industries. In general, the impacts can be summarized as Undersold Production, Oversold Production Capability, and Imposed Short-runs or Frequent Changeover requirements (Fig. 1).

Here in Part 5, we’re specifically addressing marketing-induced Undersold Production capacity. In Part 6 (the concluding installment in this series), we’ll discuss Oversold Capability and Imposed Short-run or Frequent Changeovers.

Fig. 1. Marketing Induced Overall Equipment Effectiveness (OEE) losses that impact availability.

The dark green boxes refer to conditions that specifically impact Availability performance

.

UNDERSOLD PRODUCTION

What I call “marketing-induced unavailability” spans the breadth of market conditions and marketing effectiveness. Let’s start with market conditions.

Sometimes, the economy is hot and sometimes it recesses. In a recession, there are winners and losers. Some offerings are more desirable during a recession, and the reverse is true for other offerings. As a rule, manufacturing and process plants have a heavy fixed-cost component due to their required land, buildings, production, equipment, and infrastructure. This fixed cost represents the minimum cost to the organization.

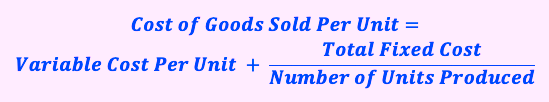

Whether an organization produces one widget or the maximum theoretical count of widgets, the fixed cost is the same. The cost of goods sold (COGS) equals the variable cost per unit plus the total fixed cost divided by the number of units produced (see equation below). If the variable cost is $2 per unit and the fixed cost is $1,000,000, the per-unit production cost equals $1,000,002 if we produce only one unit. However, the total per-unit COGS drops to $3 per unit if we produce 1,000,000 units.

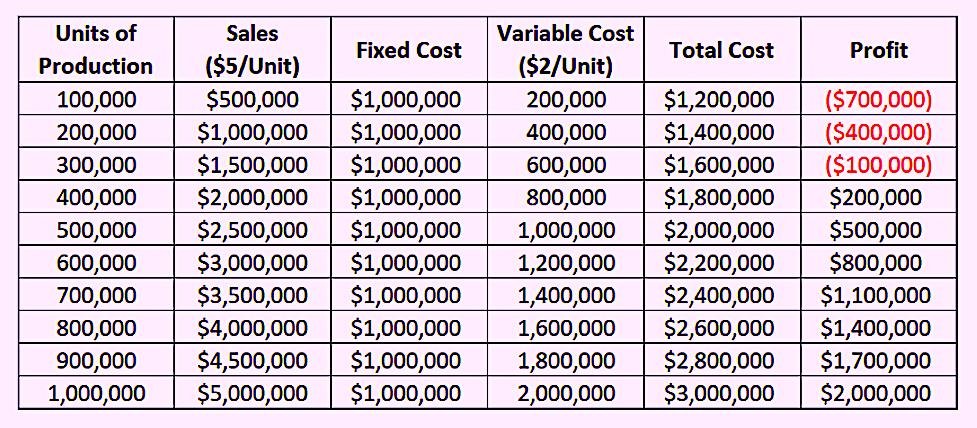

The number of produced units dramatically impacts the firm’s profits. Consider the example in Table I. Assuming a $5/unit selling price and a $2/unit variable cost, the firm breaks even somewhere between its 333,333rd and 333,334th production unit. That’s where the $1,000,000 fixed cost is covered, assuming an operating margin of $3/unit, which is calculated by subtracting the variable cost per unit from the selling price per unit.

Table I. Profit and loss summary at different production levels,

assuming a $5/unit selling price.

Ultimately, it’s the job of the marketing team to ensure that our production capacity is sold. If it’s not sold, we’re forced to alter production. Often, this creates marketing-induced asset unavailability. Specific forms this type of unavailability include:

♦ Shift Loss. Since we base our avaialbility measurement on 8,760 hours per year, reducing from three shifts per day, seven days a week to two shifts per day reduces our maxumum Avaialbility in the OEE metric to about 67%. If we’re more aggrssive and choose to produce two shifts per day during the week and no shifts during the weekend, our maximim Availability in the OEE metric drops to about 47%.

♦ Line Shutdown. For some organizations, it is possible to shut down or mothball a production line instead of reducing the number of shifts worked when the organization is undersold due to market or marketing conditions. This situation, however, still impacts availability. Assume that a plant has three lines with equal production capacity that normally operate 24 hours a day and seven days a week. Reducing from three lines to to two lines has the same net effect of reducing from three shifts to two shifts. We have two lines operating at 100% planned capacity and one line at 0%. The resultant product is an overall Availability of 67%. It’s also worth noting that when a production line is mothballed, it still requires maintenance. Non-operating equipment falls prey to static degredation mechanisms, including rust, corrosion, and fretting.

Ultimately, it’s the job of the marketing department to offer products customers want, at a price they’re willing to pay, and are distributed at a place that’s convenent for the customer. The marketing team is also responsible for properly promoting the product, including sales functions. This is often referred to as the “4-Ps of marketing” (Product, Price, Place, and Promotion).

Some markets are economically elastic, others are inelastic. In an elastic market, the number of units sold is affected by price. In an inelastic market, price has little influence on units sold. But we must be mindful of profitability when setting prices. Where market elasticity exists, we must optimize selling price and asset Availability to maximize profitability and the long-term viability of the firm. Changing the selling price in eleastic markets to increase the number of units sold can be tricky business.

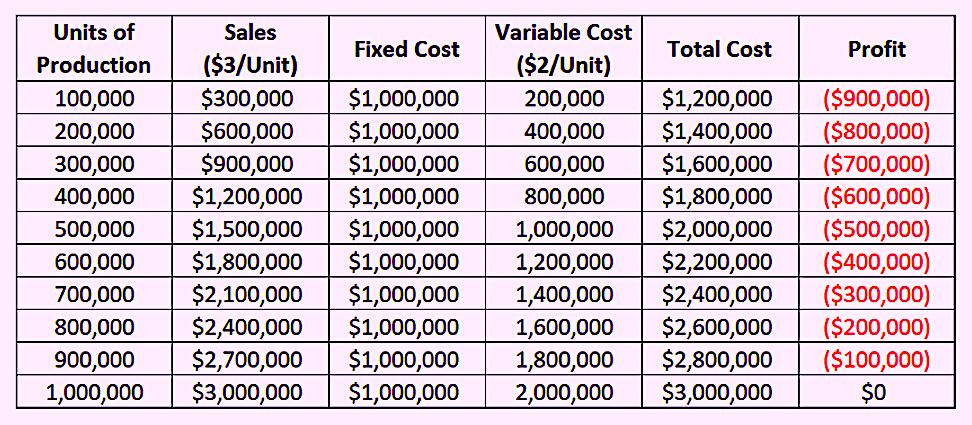

In down-market conditions, cutting the price may help to keep the production line moving and Availability performance high. But high Availability is not our ultimate goal. Profit, as measured by Earnings Before Interest & Tax (EBIT) or Earnings Before Interest, Tax, Depreciation & Ammortization (EBTDA), is our real goal. Cutting the price too deeply can be problematic for operating profitability. For example, In Table II, I’ve revised the data in Table I to refect a price cut from $5/unit to $3/unit. As you can see, would need to achieve perfect 100% Availability and maximum production just to break even. This is not a desirable scenario.

Table II. The data in Table I has been revised to reflect a $3/unit selling price.

It’s also important to consider market psychology when manipulating prices (particularly for organizations that sell to end-use consumers). If an automobile that would sell for $30,000 under normal market conditions is slashed to $22,000 during a blow-out sale to reduce inventory, the organization runs the risk that $22,000 becomes, in the minds of consumers, the new anchor point for the price of the vehicle in question. It might take a while, along with plenty of promotion and advertising for that price to creep back up the $30,000 perceived value.

CONCLUSIONS

Making smart decisions regarding optimal Availability can’t be accomplished in a vacuum. It’s a cross-functional issue that requires clear communication and cooperative analysis from all sides of the business. Although one doesn’t always think about the marketing department’s impact on Asset Availability, its impact is profound. Market conditions and how the marketing team responds to them greatly influences asset-management decisions that affect Availability and other elements of Overall Equipment Effectiveness (OEE).

As mentioned at the start of this article, next week, in the final part of this series on Availability, we’ll discuss how oversold production capability affects Availability.TRR

REFERENCES

Troyer, Drew (2008-2021). Plant Reliability in Dollars & $ense Training Course Book

ABOUT THE AUTHOR

Drew Troyer has over 30 years of experience in the RAM arena. Currently a Principal with T.A. Cook Consultants, he was a Co-founder and former CEO of Noria Corporation. A trusted advisor to a global blue chip client base, this industry veteran has authored or co-authored more than 300 books, chapters, course books, articles, and technical papers and is popular keynote and technical speaker at conferences around the world. A Certified Reliability Engineer (CRE) and a Certified Maintenance & Reliability Professional (CMRP), he holds B.S. and M.B.A. degrees. Drew, who also earned a Master’s degree in Environmental Sustainability from Harvard University, is very passionate about sustainable manufacturing. Contact him at 512-800-6031, or email dtroyer@theramreview.com.

Tags: reliability, availability, maintenance, RAM, metrics, key performance indicators, KPIs, OEE