Too often, the reward system for project managers encourages them to focus excessively on initial cost savings. Best-in-class (BiC) companies avoid upsetting the needed balance between keeping project costs in check when building the plant while, at the same time ascertaining the plant’s future safety, availability, and profitability. These issues are among the key contributors to “runnability.”

Runnability is a collective term describing the built-in safety, quality, overall uptime capability, and long-term profitability of a plant. The need to build with runnability in mind is best conveyed to the project executive by corporate higher-ups. They will inform the project executive that he or she will be involved in the plant’s startup and, thereafter, will be in charge of operating and managing the plant for three to five years.

Editor’s Note:

This article is based on a chapter in the author’s book

“Optimized Equipment Lubrication, 2nd Edition, 2021;”

De Gruyter, Berlin/Boston, (ISBN 978-3-11-074934-2).

Additional chapters will be highlighted on this website in the future.

Promotions beyond managing the plant will quite obviously be a function of the plant’s runnability achievements. It follows that storage preservation should be part of the capital budget and cannot be brushed aside by project executives. A project executive’s budgeted asset cost should never be made on the basis of lowest possible cost of equipment. Again, runnability criteria must be invoked every step of the way.

QUESTIONS ON FUNDING

While maintenance funds are counted as operating expenses, the same is not the case for capital expenditures (“capex” for short). The capex funds appropriated for new construction, occasionally called “grassroots” or “green-field” projects, undergo different cost justification and approval processes. Moreover, new construction and the great majority of plant expansion projects receive different tax treatment. As a general rule, the upgrading of an existing asset undergoing maintenance or repair is legitimately buried in the operating expenses of a plant, the process unit, or significant asset. Once upgraded, an asset will work more reliably or require less maintenance than it did before.

A similar rule can be envisioned as favoring the specification, procurement, and use of best available technology. This should be kept in mind whenever selection criteria place emphasis on assets with reliability-optimized future in-plant use in mind. It means that we may have to change our way of conducting business by adopting and emotionally supporting a better reward system. Here, we’re using a small case study to analyze the economics of a small outdoor storage yard using a pre-owned oil-mist generator (OMG). (Note that we’re using pre-pandemic cost figures throughout).

COSTS FOR SMALL OUTDOOR STORAGE YARD

USING A PRE-OWNED OMG

Based on substantial amounts of information available since 1962, a strong case can be made for allocating capital for equipment storage preservation. Oil mist will be involved, and the benefits far exceed the cost. Let’s state up front that the combined cost of a pre-owned oil-mist generator (OMG), oil holding tank, air dryer and 10 hp com- pressor can be as low as $20,000. This price is based on black iron piping; galvanized or stainless-steel pipes are not required in oil-mist systems.

Plastic pipe headers are unsuitable due to excessive sagging or temperature-induced movement. Not included are small-bore plastic tubing and connectors ($2,000). One hundred man-hours will be needed to do the installation and two experienced plumbers are needed for one week during the installation. At $80 per hour, the labor estimate is $8,000. Thus, the total amount of money needed (in 2021) for an outdoor storage yard would have been estimated to be approximately $30,000.

The probable cost of oil and air in the oil-mist preservation case is thought to be completely balanced by the cost of oil and labor required for conventional storage protection. Therefore, it is not usually considered in the projected cost comparison or cost justification calculation.

However, the above calculation should be carried out only by personnel with prior exposure to efficiently executing the requisite work processes and procedures. Because the calculation assumes in-house professionals will have a working know ledge or will have taught themselves about oil mist, the cost of hiring a contract supervisor from an experienced oil-mist provider is not included in the $30,000 estimate.

To determine additional savings, we often recommended developing a sample case (a cost workup) on paper. It would be helpful to contrast oil-mist storage protection against leaving equipment unprotected for one year. Here is a conservative estimate based on one such case:

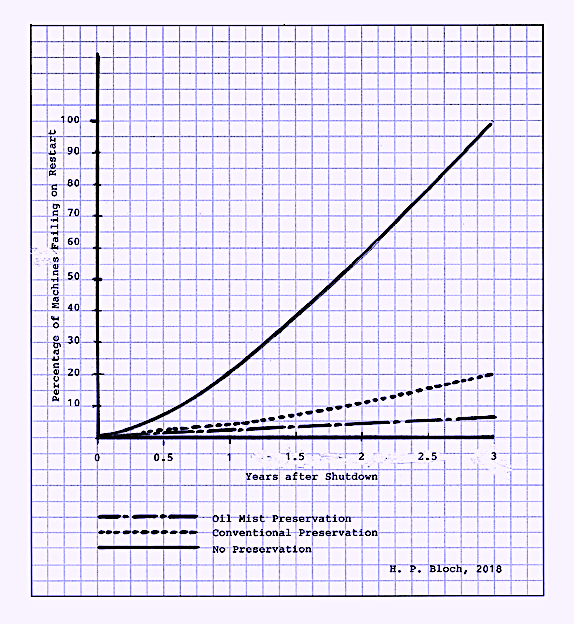

A total of 100 assets are involved. First, it is estimated that there will be two versus 22 failure events, which equates to 20 avoided infant mortality failures by using oil-mist storage preservation. At a projected repair outlay of $15,000 per infant mortality event, a plant will pay an incremental $300,000 dollars for equipment left unprotected for one year. Figure1 can help in estimating probable infant mortality as a function of storage-protection method and time.

The payback for oil mist being applied within two months of shutdown versus leaving equipment unprotected for one year is then estimated as follows:

$30,000/$300,0000 = 0.1 year or 5 – 6 weeks

Left unprotected for three years, all 100 assets in this example will have to be dismantled, cleaned, and portions of their components or parts replaced. In that case, the facility will likely incur 2 × 3 = 6 versus 100 = 94 (incremental) repair events. At a projected dismantling and repair outlay of $15,000 per event, a plant would incrementally pay $1,410,000 for equipment left unprotected for three years.

Fig. 1. Percentage of machines failing within

Fig. 1. Percentage of machines failing within

2 to 4 weeks of restart after shutdowns in wet or desert climates.

(Source: Heinz P. Bloch)

The payback time for oil mist applied within two months of shutdown versus leaving equipment unprotected for three years is as follows:

$90,000 /$1,410,000 = 0.064

This would be the fraction of 3 × 365 days = 1,095 days. Payback is 70 days, a little over two months. You can make your own projections by substituting or plugging in appropriate numbers.

However, we wish to stress the fact that the example we used here is based on an actual experience. We had been asked to advise a major U.S. oil refinery that received and then stored equipment in the open for three years. While there was a huge storage yard, there was no storage preservation. When the economy took a downturn, this refinery’s internationally known corporate management had advised local subordinates to immediately stop all work on a US $1 billion (870 million euro) expansion project. Roughly three years later, corporate managers asked the locals to go ahead and pick up where they had left off.

We emphasized the prudent course of proactively dismantling, cleaning, occasional parts replacing and reassembling many of the previously unprotected machines. We explained to the managers and senior staffers of this world-scale refinery that they were now confronted with a series of unpleasant choices.

COSTS FOR FUTURE LARGE OUTDOOR STORAGE YARDS

WITH FACTORY-NEW OMGS

Using cost information available in the book from which this article excerpt is taken (see editor’s note above), it’s easy to make the case for capital budgets that include proper outdoor equipment-storage preservation. For this particular example, assume a first-class, permanent, unit-wide system providing state-of-the-art lubrication to 70 motor-driven pump sets. While half of these pump sets are on standby duty, they are fully preserved by oil mist. With the oil-mist-lubrication system initially doing outdoor-storage-protection duty, an estimated 300 assets will be preserved under an oil-mist sweep that completely fills all casings and bearing housings in the storage yard.

In this case, the installed cost of a new OMG and a new 500-gal. oil holding tank is estimated at $150,000. Arrangements were to be made for one of the unit’s future instrument air compressors and dryers to be brought in early to provide the motive air for the oil mist supply in the storage yard. Scaling up and using the small yard/used equipment case as the pricing model, a total incremental cost of $200,000 is budgeted. Anything beyond that amount would be part of the plant’s normal piping design and construction budget.

Again, the cost outlay is calculated based on the oil-mist system being used initially in a storage yard and later transferring the OMG and its associated hardware to one of the facility’s process units. There are firm plans to ultimately use it as a unit-wide oil mist supply source. Therefore, an all-inclusive cost justification would include using oil mist for pumps and electric motor drivers. A rigorous cost justification would take into account labor savings, considerable failure avoidance, and having fewer fire incidents.

BUDGETING OIL-MIST PRESERVATION

In early 2008, a Texas-based Reliability Engineer expressed surprise over the fact that a $4-million cost proposal he had just received for a plant-wide oil-mist system was not close to the cost projected in an oil-mist-lubrication handbook he had read in 1987. Well, not only had things changed in the intervening 21 years, but it was clear from the ensuing conversation that serious misunderstandings tend to creep in when people do spotty and selective reading. The situation is even worse when project advisors relay their misunderstood tidbits of information as current fact.

The recommendations and actions of Reliability Professionals must be based on facts, and these facts must be presented with integrity and without misleading, in any way, the reader, technician, or manager. Diverging views must be explained and reconciled. There can only be one fact, although it is possible to support an agenda and one’s views or opinions by leaving out portions of the complete story. However, deliberately leaving out facts is dishonest; the individual who leaves off facts is a professional in name only. Of course, comments by an uninformed, careless, or indifferent person may inadvertently leave out facts. But, irrespective of whether purposeful or inadvertent, omissions can be avoided, and true professionals will not become a party to the dissemination of misinformation.

Which leads us, again, to the topic of context. Diverging views can, for the most part, be reconciled by looking at full context.

WHY CONTEXT MATTERS

In 1990, the presenter at a technical conference showed images of a large number of different process pumps with stainless steel (hydraulic) tubing connected to each bearing housing. Other images depicted outdoor storage yards with plastic oil-mist tubing. It was noted that plastic tubing is perfectly acceptable for stored equipment, but stainless-steel tubing was needed in a process unit. The reason why such tubing was to be specified for machines within the boundaries of a refinery process unit had to do with fire issues. Heat from fire in a nearby pump could melt plastic tubing in an otherwise unaffected machine. The real message tends to be lost or badly misinterpreted if all that we remember is the partial sentence “… plastic tubing is perfectly acceptable.”

There is not enough time here to relate even a fraction of the many tales and anecdotes that are being passed along over a few beers at barbecues. Examining facts and becoming familiar with the underlying science makes eminent sense.

Facts are worthy of being brought to the attention of every functional layer in a reliability-focused organization. Opinions, anecdotal banter, and sentences quoted out of context can pose serious risks to the safety and profitability of a plant. When opinions take over, deviations from the original quality norm tend to become the “new normal” and repeat failures are experienced.TRR

Editor’s Note: Click Here To Download A Full List Of Heinz Bloch’s 24 Books

ABOUT THE AUTHOR

Heinz Bloch’s long professional career included assignments as Exxon Chemical’s Regional Machinery Specialist for the United States. A recognized subject-matter-expert on plant equipment and failure avoidance, he is the author of numerous books and articles, and continues to present at technical conferences around the world. Bloch holds B.S. and M.S. degrees in Mechanical Engineering and is an ASME Life Fellow. These days, he’s based near Houston, TX.

Tags: reliability, availability, maintenance, RAM, oil-mist generators, equipment storage preservation, outdoor equipment storage yards, electric motors, pumps, compressors, blowers, gearboxes, bearings, lubrication, lubricants, oil mist